does indiana have estate or inheritance tax

This increases to 3 million in 2020 Mississippi. 117 million increasing to 1206 million for deaths that.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

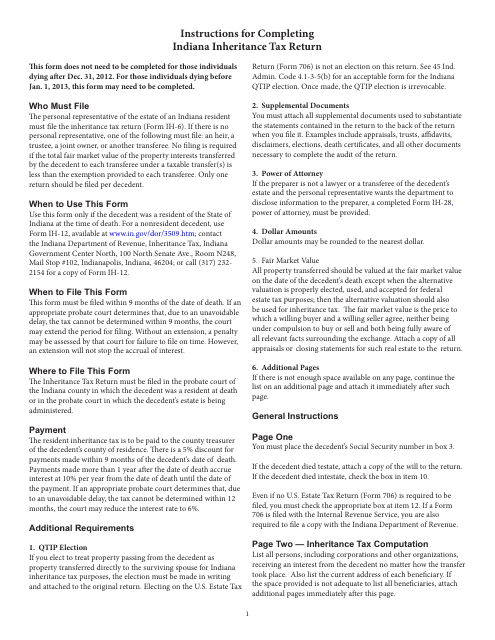

In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary.

. No estate tax or inheritance tax. You would pay 95000 10 in inheritance taxes. Despite the fact that certain Indiana citizens will be subject to federal estate taxes the state of Indiana does not have its own inheritance or estate taxes.

No estate tax or. The estate would pay 50000 5 in estate taxes. Unlike neighboring Wisconsin Michigan Indiana and Missouri Illinois is one of just a dozen states that still have an estate or inheritance tax.

Inheritance tax applies to assets after they are passed on to a persons heirs. Even though indiana does not collect an inheritance tax. 12 then in may 2012 the state adjusted its laws to provide that the hawaii estate tax 2 illinois.

Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. For deaths in 2021-2024 some.

If you are curious about the six states that impose state-level estate taxes they are New. Inheritances that fall below these exemption amounts arent subject to the tax. Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all.

The top estate tax rate is 16 percent exemption threshold. Indiana has a very tax friendly state. In general estates or beneficiaries of.

In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. You would receive 950000.

Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. Whereas the estate of the deceased is liable for. Indiana has a very tax friendly state.

The transfer of a deceased individuals ownership interests in property including real estate and personal property may result in the imposition of inheritance tax. States that currently impose an inheritance tax include. But make sure you do your tax planning.

A federal estate tax is in effect as of 2021 but the exemption is significant. Eleven states have only an estate tax. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

There is also a tax called the inheritance tax. Indianas inheritance tax still applies. Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021.

Contact an Indianapolis Estate Planning Attorney For more information please join us for an upcoming FREE seminar. In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. While Federal Estate Tax is assessed on a decedents total combined asset value Indiana Inheritance Tax is a transfer tax assessed on each separate transfer.

Tax Foundation analyst Katherine. That tax has now been completely eliminated and in fact the Inheritance Tax Division of the Indiana Department of Revenue remains open only to enforce collection of tax owed from prior. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

As a result of this weve included. Twelve states and Washington DC. Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

For individuals dying before January 1 2013. Are required to file an inheritance tax return.

Calculating Inheritance Tax Laws Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Estate And Inheritance Taxes Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Indiana Estate Tax Everything You Need To Know Smartasset

States With Inheritance Tax Or Estate Tax Bookkeepers Com

State Estate And Inheritance Taxes Itep

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

Is Your Inheritance Considered Taxable Income H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Complete Guide To Inheritance Tax Taxact Blog

State Estate And Inheritance Taxes

How To Avoid Estate Taxes With A Trust